The Tokenization Choice: Direct or Indirect?

TL;DR:

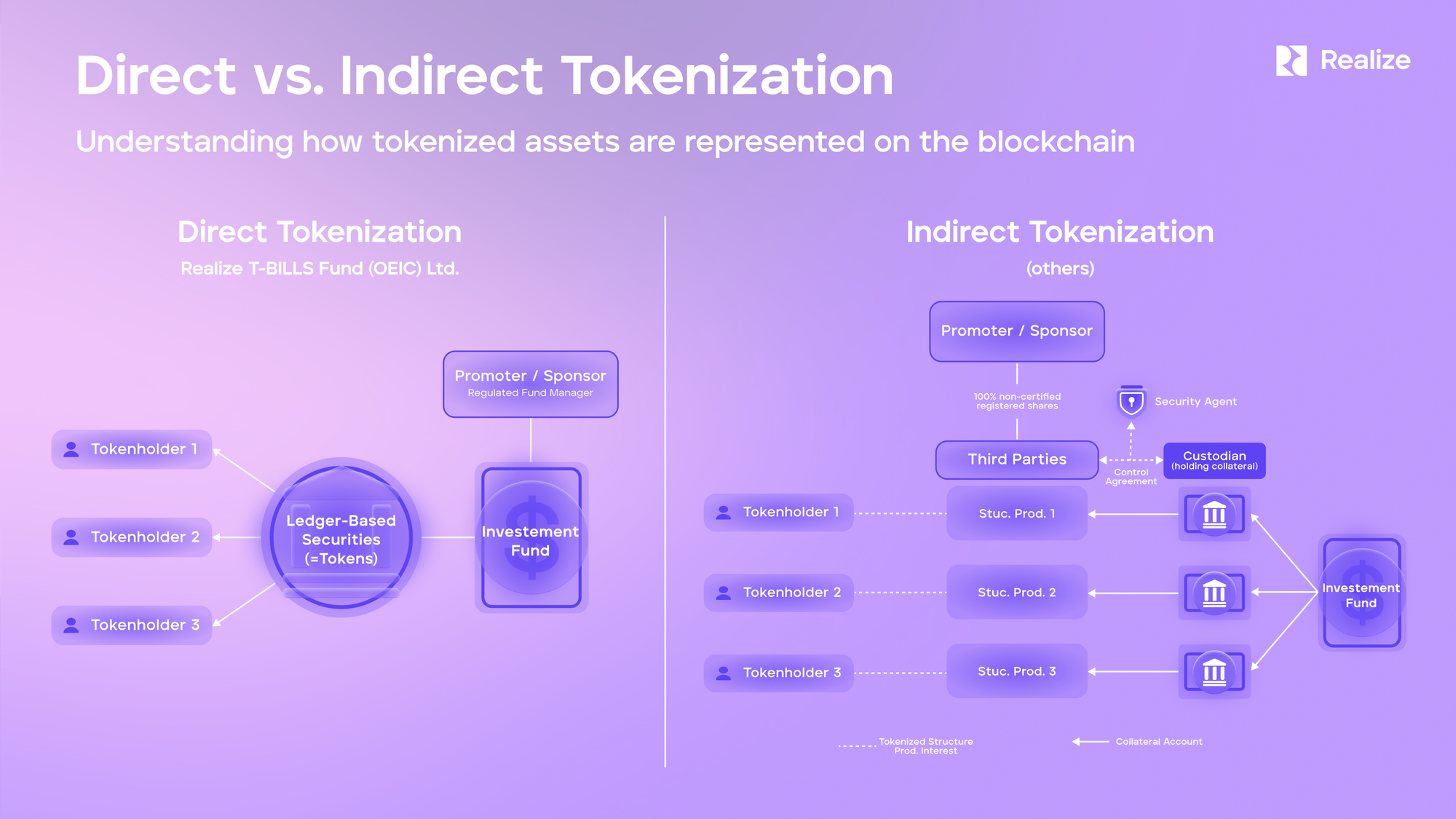

Direct tokenization transforms real-world assets into blockchain tokens that represent direct ownership in the fund and its underlying assets, offering transparency and simplicity. In contrast, indirect tokenization involves the use of third parties, like SPVs, which hold the asset on behalf of token holders and must be trusted. This can add complexity, additional trust layers and fees, and makes the structure more opaque to understand. The Realize T-BILLS Fund (OEIC) Limited in ADGM champions direct tokenization, providing investors with direct ownership and transparent asset value.

Tokenization has emerged as a pivotal process, transforming real-world assets into digital tokens on a blockchain. Understanding the difference between direct and indirect tokenization is essential for grasping how the tokenized structure is managed and the risks involved.

Direct tokenization

Direct tokenization involves converting a share registry of a fund directly into a digital token on the blockchain. Instead of receiving a traditional share certificate, investors receive a token that represents their ownership in the fund through direct tokenization. This type of token directly represents a specific asset or ownership in a fund, such as private equity, stocks, or U.S. T-Bills. The main advantage of direct tokenization is its simplicity and transparency. The token's value is directly tied to the underlying asset, making it easy for investors to understand and verify ownership and value.

For example, consider a fund that is directly tokenized. In this scenario, a blockchain token could represent fractional ownership of the fund. Each token holder has a direct claim to their share of the fund, and transactions involving these tokens are recorded on the blockchain, providing a transparent and immutable record of ownership changes.

Indirect tokenization

Indirect tokenization involves a more complex structure where the token does not directly represent the asset but instead represents a claim or right to the asset managed by a third party. At this point, Special Purpose Vehicles (SPVs), nominee shareholders or custodians (the “Third Parties”) come into play. In the context of tokenization, the Third Parties hold the asset or shares and issue tokens representing claims to it.

In indirect tokenization, token holders do not own the asset outright but have a claim to it through the Third Parties. Indirect tokenization can introduce additional layers of complexity, risk and potential for increased fees due to the involvement of the Third Parties. Additionally, it may pose greater legal and regulatory challenges, as the indirect ownership structure can complicate the verification of claims and rights to the underlying assets.

Realize's direct tokenization leap

Realize, a leading tokenization platform, supports the first tokenized U.S. T-Bills Fund in Abu Dhabi Global Market (ADGM), offering fully decentralized trading and transferability of ownership rights in the fund. We are proud to offer direct tokenization to users, providing them with various benefits such as enhanced transparency, simplified asset management, and straightforward verification of ownership and value. Additionally, Realize collaborates with trusted, regulated financial service providers, including Neovision Wealth Management as the authorized fund manager, Ascent as the fund administrator, and Swissquote for custody of the fund’s underlying assets, ensuring secure and compliant asset handling.

Learn more about Realize and our tokenization platform:

www.realizeassets.com

Disclaimer

Realize Technology Solutions Limited is an unregulated private limited company with a commercial licence to provide technology and software solutions. The information provided on the Site is for informational purposes only and does not constitute financial, legal, investment advice, or any other form of advice. You are strongly encouraged to seek independent financial, legal, and tax advice from qualified professionals before making any investment decisions, given the significant risks associated with investing in tokenized real-world assets or financial products.